Introduction

The concept of halving plays a significant role in the world of cryptocurrencies, especially when it comes to Bitcoin. Whether you are a seasoned investor or just starting to explore the world of digital currencies, understanding what Bitcoin halving is and how it affects the price of Bitcoin is essential.

In this article, we will delve into the depths of halving and its impact on the price of Bitcoin. If you want to know more about what determine the price of Bitcoin, you may check out this article.

Bitcoin Halving: A Brief Overview

Bitcoin halving is an event built into the cryptocurrency’s code that reduces the block reward given to miners by half. This means that the rate at which new Bitcoins are created decreases, leading to a reduced supply entering the market.

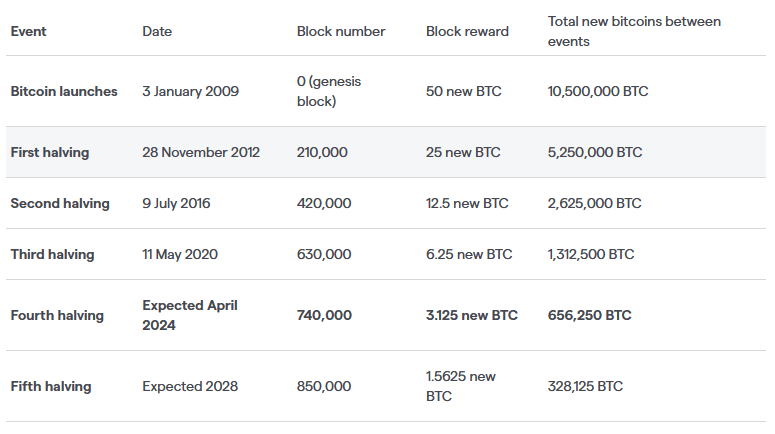

The process occurs every 210,000 blocks, roughly four years, and is an essential mechanism for controlling inflation and ensuring the scarcity of Bitcoin.

The halving event cuts the rate at which new Bitcoins are created in half, hence the name “halving.” This reduction in supply has a profound impact on the Bitcoin price.

The Supply and Demand Dynamics

Bitcoin is often referred to as “digital gold” due to its limited supply. Similar to gold, which requires extensive mining efforts to extract, Bitcoin also undergoes a mining process.

Miners solve complex mathematical problems to validate transactions and add them to the blockchain, the underlying technology of Bitcoin.

With each successful block added to the blockchain, miners are rewarded with a certain number of newly minted Bitcoins. However, as mentioned earlier, every four years, this reward is halved.

The initial reward was 50 Bitcoins, which was reduced to 25 Bitcoins in the first halving event. The second halving event reduced it to 12.5 Bitcoins, and so on.

This reduction in the mining reward has a direct impact on the supply of new Bitcoins. As the supply decreases, the demand remains constant or even increases due to the growing interest in Bitcoin. This supply-demand imbalance often leads to a rise in the price of Bitcoin.

Historical Impact on Bitcoin Price

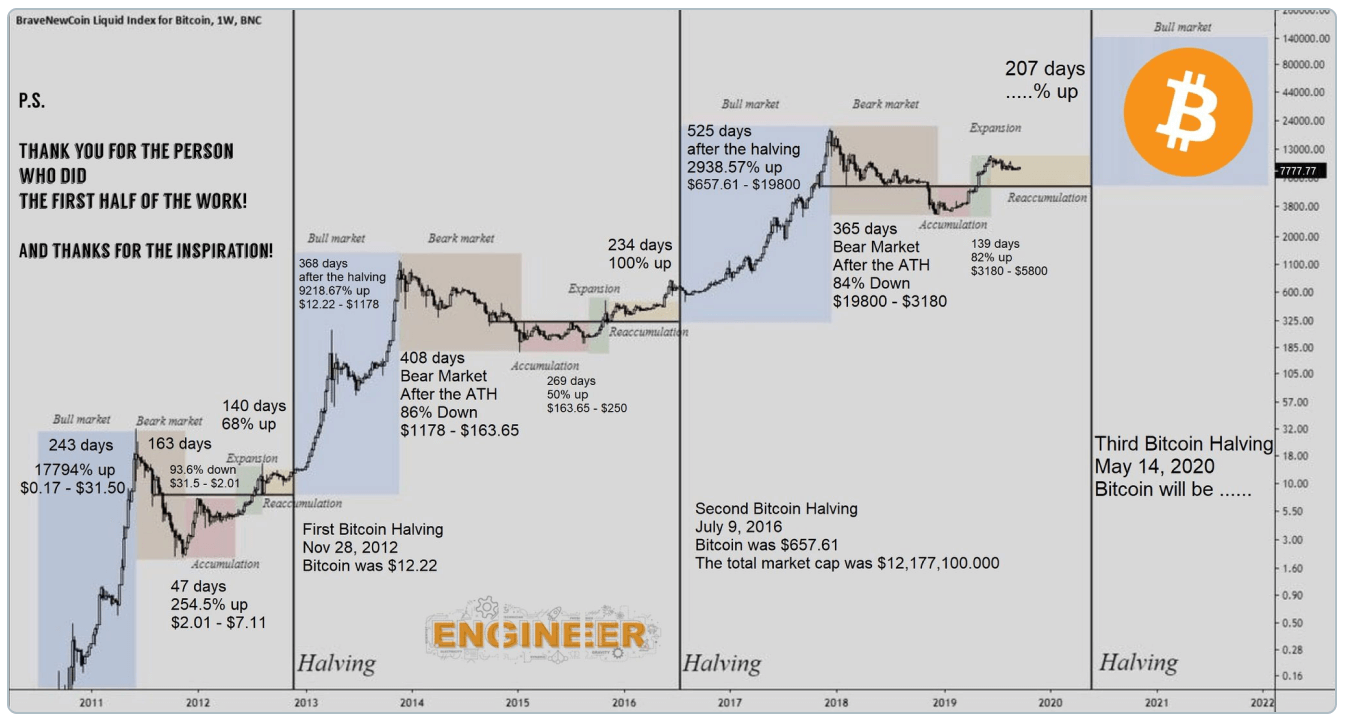

Looking back at previous halving events, we can observe a clear pattern of how they affect the price of Bitcoin. In both the 2012 and 2016 halvings, the Bitcoin price experienced significant surges in the months following the event.

During the 2012 halving, the price of Bitcoin increased from around $12 to over $1000 within a year. Similarly, after the 2016 halving, the price surged from approximately $650 to nearly $20,000 in the following year.

Although past performance is not indicative of future results, it is worth noting the historical impact halving has had on the Bitcoin price.

After the halving event, the price can exhibit short-term volatility as market participants react to the new supply dynamics. It may take some time for the market to fully absorb the implications of reduced supply, leading to potential price fluctuations.

Furthermore, long-term price trends are influenced by a combination of fundamental factors, market sentiment, and external events.

Market Sentiment and Investor Behavior on Bitcoin Halving

Halving events often generate a sense of excitement and anticipation within the Bitcoin community. The reduction in supply creates a perception of scarcity and provokes curiosity among investors. This increased interest can lead to a surge in demand and subsequently drive up the price of Bitcoin.

Additionally, some investors may adopt a “buy and hold” strategy during halving events, expecting a potential increase in price. This behavior, coupled with the overall market sentiment, can further contribute to the price appreciation of Bitcoin.

However, it’s important to note that market sentiment alone does not guarantee a price increase. The price of Bitcoin is influenced by a complex interplay of factors, including market psychology, technological advancements, regulatory developments, and global economic conditions.

While halving can create a bullish sentiment, it’s essential to consider the broader market context.

Conclusion

In conclusion, halving is a critical event that has a substantial impact on the price of Bitcoin. The reduction in supply creates a supply-demand imbalance, often resulting in an increase in Bitcoin’s value.

However, it is important to note that the cryptocurrency market is highly volatile and influenced by various factors, so it is essential to conduct thorough research and exercise caution when making investment decisions.

Understanding the basics of halving and its implications can help investors make more informed decisions in the ever-evolving world of cryptocurrencies.

Also, check out the latest coin “Celestia” here : https://www.kintechie.com/how-to-stake-celestia-and-deep-dive-into-celestia/

Featured Photo by RDNE Stock project

One thought on “What is Bitcoin Halving, Will the Price Skyrocket?”

Comments are closed.