What Determines the Price of Bitcoin?

The price of Bitcoin, the pioneering cryptocurrency, is a subject of great interest and speculation in the financial world. Understanding the factors that determine its price can help investors and enthusiasts make informed decisions.

Furthermore, Bitcoin is the world’s first decentralized digital currency and has become a hot topic in recent years. As its popularity continues to grow, many people are curious about what factors influence its price.

In this article, we will delve into the key elements that influence the value of Bitcoin. Check the latest Bitcoin price here.

Price of Bitcoin: Then and Now

On May 22, 2010, two pizzas were purchased in exchange for 10,000 BTC, marking the first-ever Bitcoin transaction. At that time, the value of one BTC was $0.004.

This event paved the way for the acceptance of Bitcoin as a medium of exchange for goods and services, leading to the development of a thriving market where the prices of assets are determined through free market mechanisms.

Since then, the use of Bitcoin has expanded significantly, with people buying a wide range of items, including luxury goods and real estate, using BTC as a means of payment.

Over the years, the price of Bitcoin has experienced substantial growth due to high demand surpassing the available supply. Since July 2020, the price of Bitcoin has consistently remained above $10,000 and even reached an all-time high of $69,990.90 in November 2021.

Nowadays, the primary method for determining the price of Bitcoin is through centralized crypto exchanges (CEXs), where it is traded for fiat currencies like the USD, EUR, KRW, and other cryptocurrencies such as ether (ETH) and litecoin (LTC), rather than relying on BTC-to-pizza exchanges.

Supply and Demand

Like any other asset, the price of Bitcoin is primarily influenced by the basic economic principles of supply and demand.

Bitcoin’s supply is predetermined by its underlying technology, the blockchain, which limits the total number of Bitcoins that can ever exist to 21 million. This scarcity creates a sense of value and drives demand.

When the demand for Bitcoin exceeds its available supply, the price tends to rise. Conversely, when the demand decreases or supply increases, the price may drop. Therefore, fluctuations in Bitcoin’s price can largely be attributed to changes in supply and demand dynamics.

Market Sentiment

Another significant factor impacting the price of Bitcoin is market sentiment. Bitcoin is a highly speculative asset, and its value can be influenced by investors’ perceptions, emotions, and expectations.

Moreover, positive news, such as regulatory approvals, institutional adoption, or mainstream acceptance, often drives up the price due to increased optimism and demand.

Conversely, negative news, such as security breaches, regulatory crackdowns, or major market corrections, can decrease market sentiment and cause the price to decline. It’s important to note that market sentiment can be highly volatile, leading to rapid price fluctuations in the short term.

Integration and Acceptance

The integration and acceptance of Bitcoin as a payment method also influence its price. As more businesses and merchants begin to accept Bitcoin as a form of payment, its utility and demand increase. This, in turn, can positively impact its price.

Additionally, the development of user-friendly wallets and platforms that facilitate Bitcoin transactions can attract more users, further driving demand.

Technological Developments

The continuous development and innovation surrounding Bitcoin’s underlying technology can also impact its price. Improvements in scalability, security, and usability can increase the adoption and utilization of Bitcoin, positively influencing its value.

Additionally, upgrades like the implementation of the Lightning Network, which enables faster and cheaper transactions, or advancements in privacy features, can attract more users and investors, driving up demand and subsequently the price.

Regulation and Government Actions

Regulatory developments and government actions play a crucial role in shaping the price of Bitcoin. Governments’ acceptance or rejection of cryptocurrencies, as well as their policies regarding taxation and oversight, can significantly impact investor confidence and market stability.

For example, favorable regulations, such as the recognition of Bitcoin as legal tender or the establishment of cryptocurrency-friendly frameworks, can foster a positive environment for Bitcoin’s growth and drive up its price.

Conversely, strict regulations or bans can create uncertainty and negatively impact its value.

Market Manipulation on Price of Bitcoin

Bitcoin’s decentralized nature makes it vulnerable to market manipulation. Whales, individuals or entities with large Bitcoin holdings, can influence the market by buying or selling significant amounts.

Thus, their actions can create artificial price movements, causing volatility and impacting smaller traders and investors.

Moreover, the presence of fraudulent schemes, such as pump-and-dump schemes or fake news campaigns, can also affect Bitcoin’s price. It’s important for investors to stay informed and cautious to avoid falling victim to such manipulative practices.

Market Liquidity

Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price.

In summary, market liquidity is a critical factor in determining the price of Bitcoin. Highly liquid markets tend to have more stable prices, narrower spreads, and lower slippage, while illiquid markets or lower liquidity are more prone to price volatility and manipulation.

Traders and investors should consider liquidity when choosing exchanges and executing trades, as it can significantly impact their trading experience and outcomes.

Market Events

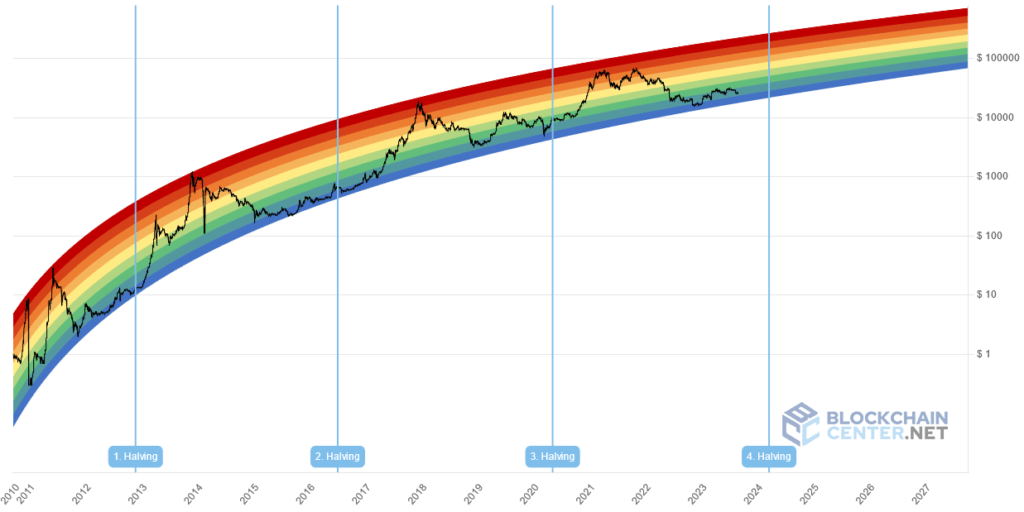

Events such as Bitcoin halving (a reduction in the rate at which new Bitcoins are created) can impact the supply side of the equation. Halvings historically have correlated with significant price increases.

Read more about halving and how it affects the price here. https://www.kintechie.com/what-is-bitcoin-halving-will-the-price-skyrocket/

Global Economic Factors

Bitcoin, as a decentralized digital currency, can be influenced by global economic factors. Economic instability, inflation, or currency devaluation in certain regions can drive individuals to seek alternative investments, such as Bitcoin, as a store of value.

These macroeconomic conditions can impact the demand for Bitcoin and subsequently affect its price.

Conclusion

While the price of Bitcoin can experience significant volatility, understanding the factors that determine its value can provide valuable insights for investors and enthusiasts.

Supply and demand dynamics, market sentiment, technological developments, regulation, and market manipulation all play a role in shaping Bitcoin’s price.

As the cryptocurrency market continues to evolve, it’s essential to stay informed and keep a close eye on these factors to make informed decisions and navigate the exciting world of Bitcoin.

Featured Photo by Kanchanara on Unsplash

One thought on “What Determines the Price of Bitcoin?”

Comments are closed.